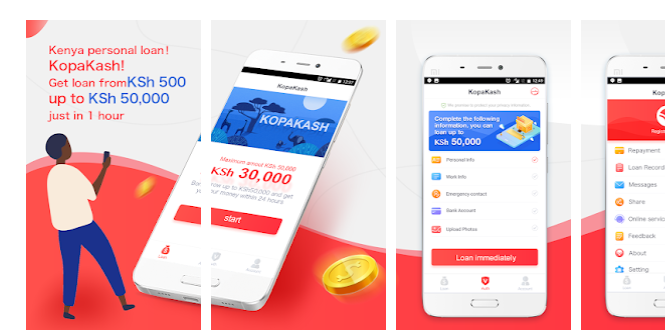

Kopakash is a digital lending platform, that charges a service fees according to the product you choose, which is used for credit score assessment, account management, and payment cost.

KopaKash can give a quick loan to help everyone in Kenya who need money to grow their businesses, pay for school fees, buy things or finance any other emergencies.

One can qualify for a loan Amount ranging from KSh 1,000 – KSh 50,000 and the repayment period is from 91 days to 120 days.

Why loan from KopaKash?

- No credit history required

- Paperless and digital process on your mobile

- Get 7/24 access to loan anytime and anywhere

- Speedy review in 30 minutes

- Disburse to your bank account or M-PESA directly in 5 minutes once approved

- Available across Kenya

- As the credit score grows, the loan amount gradually increases

- Variety of convenient repayment methods (Lipa na Mpesa and Bank)

Eligibility:

- Kenya Resident

- 18-60 years old

- has a monthly source of income.

How to register with Kopakash

- Install the KopaKash APP from the Play Store or click here to install

- Register with your M-PESA phone number.

- Select the product you would like to apply for.

- Fill in your basic information and upload your KYC documents, then submit the application.

- The final application result will be shown in the APP and sent via SMS if approved.

- E-sign the loan agreement after the approval.

- After the E-sign, the approved loan

Kopakash contacts and email

In case a customer has any feedback, questions, or concerns, e-mail kopakash at cs@kopakash.com